Learn about commodities training

A commodity is a basic item used in trade as an interchangeable with other goods of the same type. Some common examples of commodities include gold, oil, beef and even natural gas.

Moving away from traditional insecurities, investors see commodities as an important way to diversify their portfolio. And since the prices of commodities tend to move in a different direction than stocks, some investors also depend on commodities when market is volatile.

While in the past, commodities trading required a lot of time, money and expertise and was mostly restricted to professionals, today there are more choices for those interested to participate in commodity markets.

Before we go on further exploration about commodities it is imperative to first understand the types of commodities and the way they are classified.

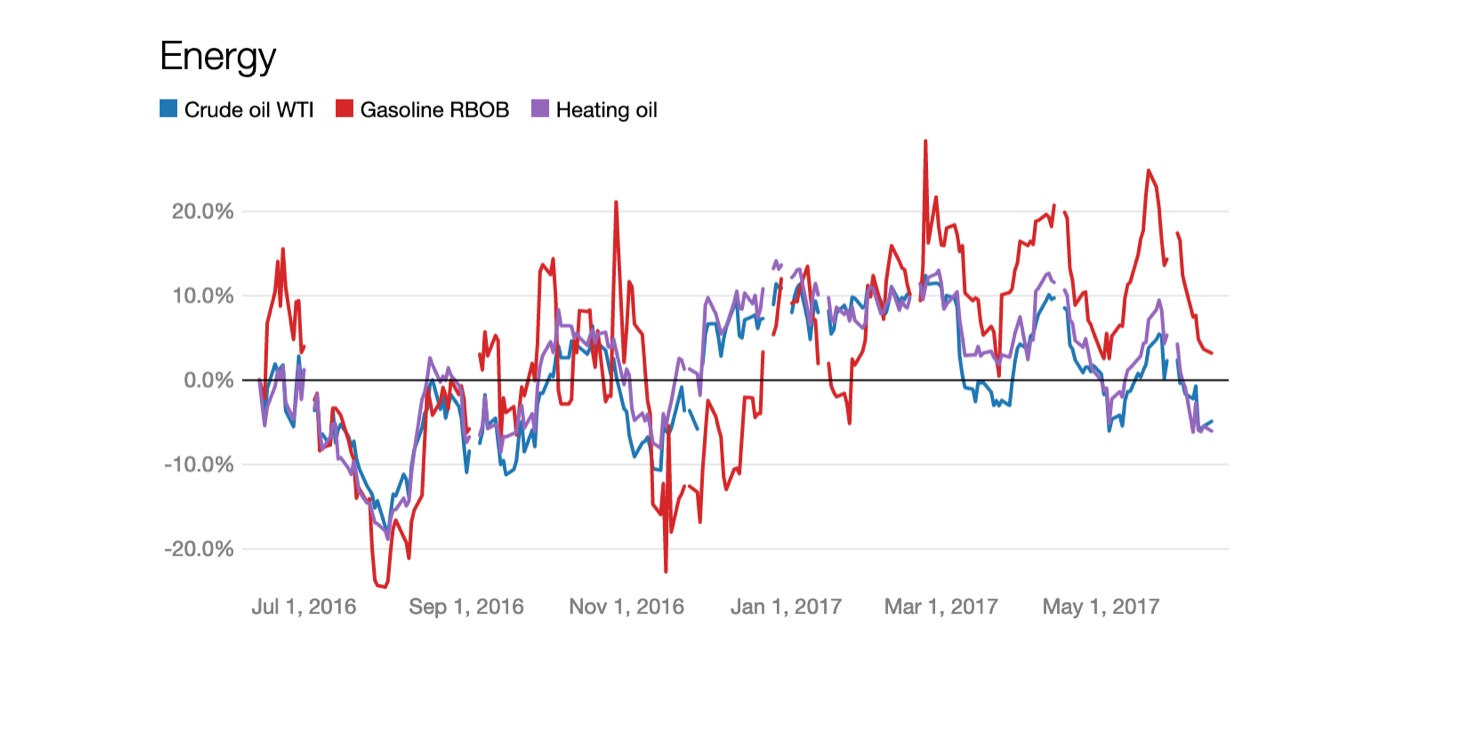

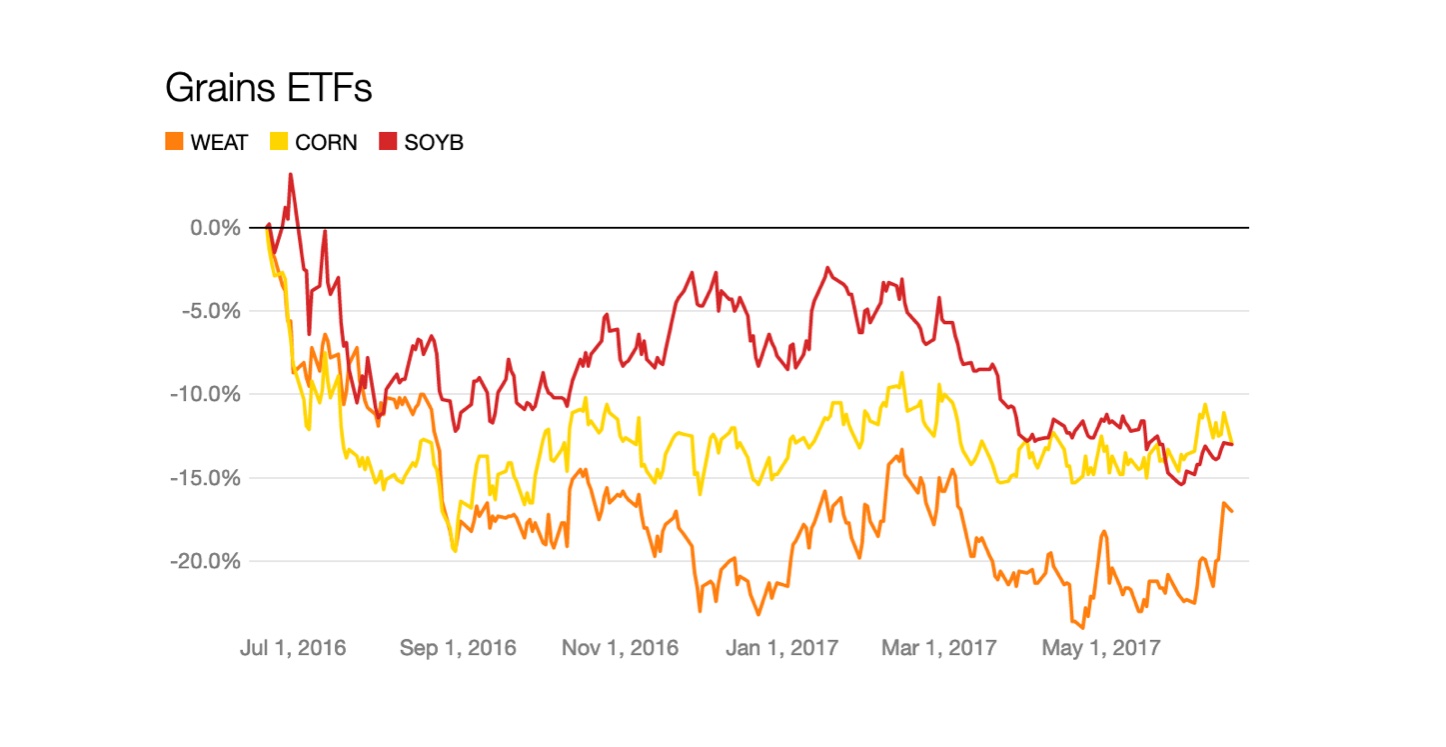

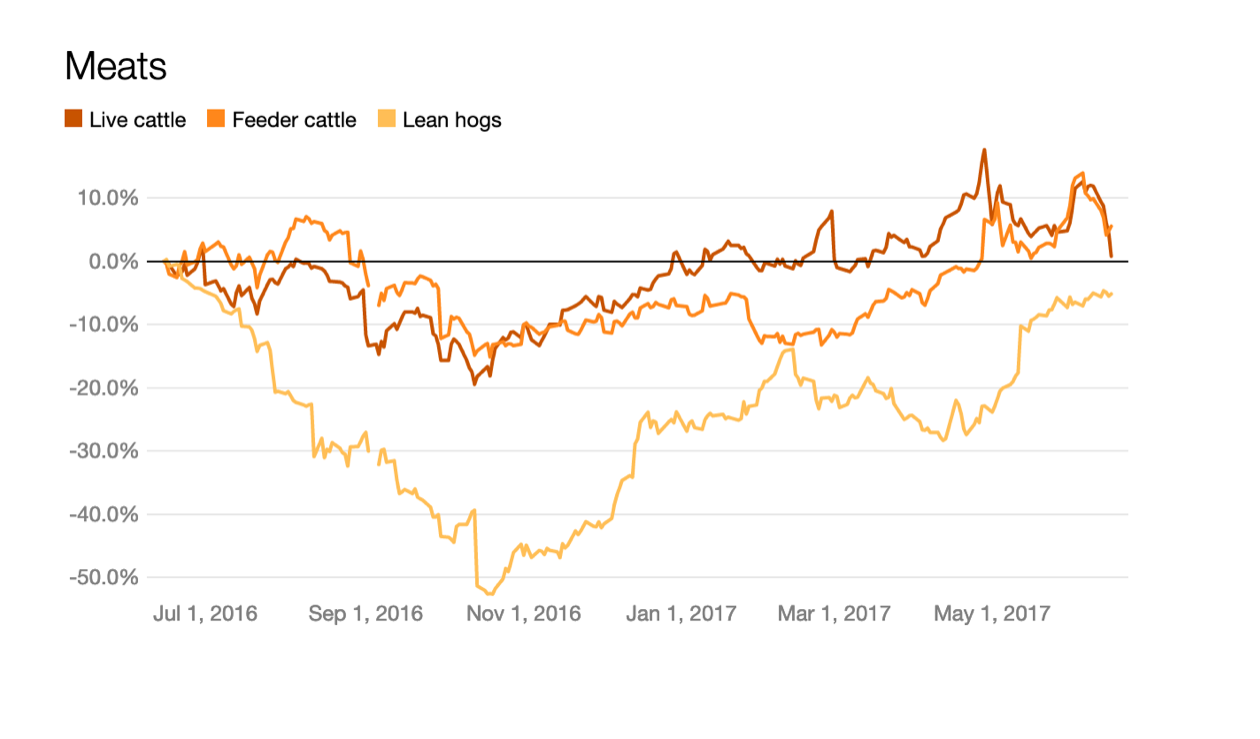

Typically commodities can be categorized into four broad groups: metal, energy, livestock, agricultural and meat.

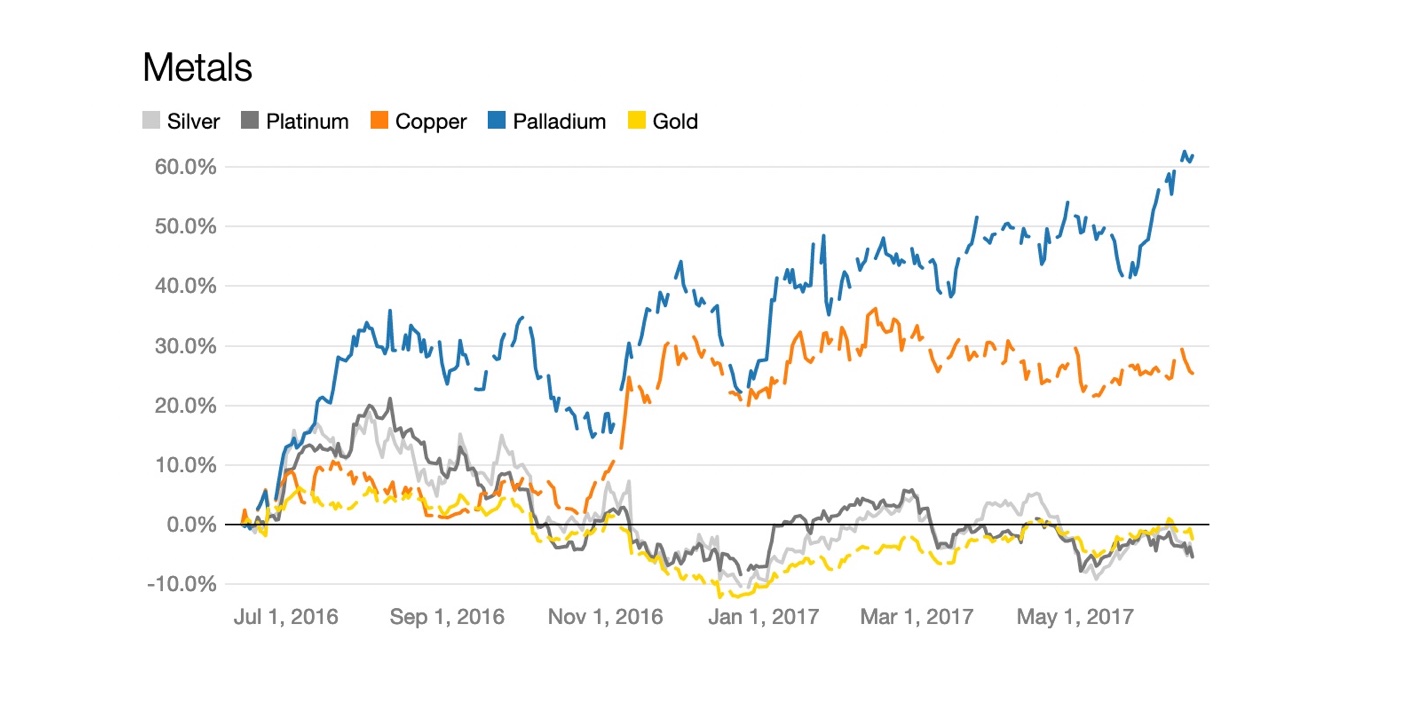

Metals

This category includes gold, silver, copper, and platinum. Some investors decide to invest in precious metals like gold when markets are volatile. Gold is the preferred metal particularly because of its status as the most dependable and real metal that has a conveyable value. Investments in precious metals are also seen as insulation against high inflation or when currency devalues.